We’ve all been there. Twiddling our thumbs as we wait for a client to pay us. The date of the invoice deadline swims past and the thoughts start to crop up:

“Should I chase my client for payment?”

“Are they going to pay me at all?”

“How am I going to pay rent this month – do they know how stressful this is?”

If you are reading this, you’re probably in the same repetitive thought cycle that consumes many freelancers and solopreneurs when it comes to chasing payment.

We want to keep our clients happy so how do we word our chaser email in a polite way? When is it reasonable to start chasing? I’m going to break that all down in today’s article.

I’ll even throw in some bonus tips to ensure you (almost) never have to chase for payment again.

I first want to touch on the reasons why some clients may delay when paying us.

I don’t know about you but when I have a late-paying client, it often feels personal. I cast my mind back and wonder if I have offended them in some way. I worry if I’ll get paid at all and neurotically check my contracts to see what legal backup I would have for claiming payment if the client disappears.

If you are not in this mindset, feel free to skip to the next section. To my fellow Type As out there pulling their hair out at this moment – I’ve got you. Here are the real reasons why your client is taking too long to pay you.

I can’t be the only person out there who sends an invoice on a Monday morning and then obsessively checks their bank account all Monday afternoon to see if the money has arrived… or am I?

The question behind the question here is when is an invoice considered “late”?

The first thing to review is whatever it says on your contract or the agreed terms before you started the work. There is the date that the invoice is created and the date that the invoice is due.

You can, in theory, set payment terms that your invoice is due the date that you send it, but there is commonly a grace period. This grace period is particularly important for online businesses.

How long does a client have to pay an invoice?

You can, in theory, start chasing your client as soon as the invoice due date has passed but keep in mind the grace period that was set.

My advice would be to wait for another 4-7 days after the end of the payment term before chasing the payment.

This is simply anecdotal. Sometimes the client pays on the last possible day of the invoice and it takes a couple of days to arrive in your bank account.

It is okay to ask for payment and remind your client that their invoice is due. Try not to overthink this process.

The best course of action is to remind before and after to give your client plenty of wiggle room:

I have been so kind as to give you actual example templates I would use to chase for payment. The trick is to start soft and progressively get more serious.

You don’t want to start off all guns blazing “where is my money??!!”. It screams desperation and that client will not want to work with you again.

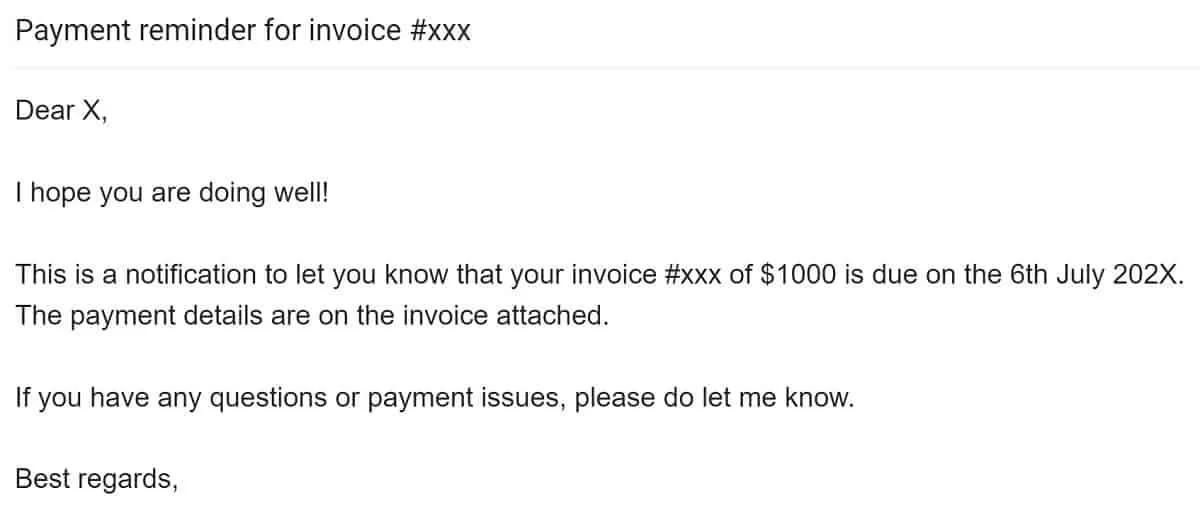

Text to copy paste:

Dear [CLIENT NAME],

I hope you are doing well!

This is a notification to let you know that your invoice [INVOICE NUMBER] of [INVOICE AMOUNT] is due on [DATE].

The payment details are on the invoice attached.

If you have any questions or payment issues, please do let me know.

Best regards,

[YOUR NAME]

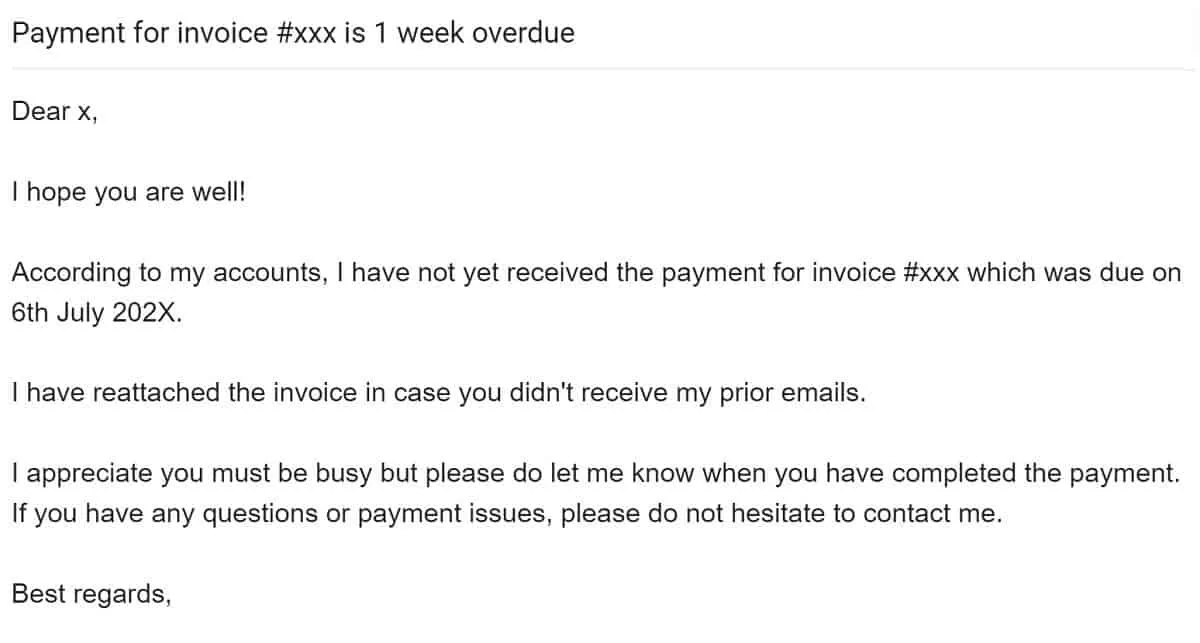

Text to copy paste:

Dear [CLIENT NAME],

I hope you are well!

According to my accounts, I have not yet received the payment for invoice [INVOICE NUMBER] which was due on [DATE].

I have reattached the invoice in case you didn’t receive my prior emails.

I appreciate you must be busy but please do let me know when you have completed the payment. If you have any questions or payment issues, please do not hesitate to contact me.

Best regards,

[YOUR NAME]

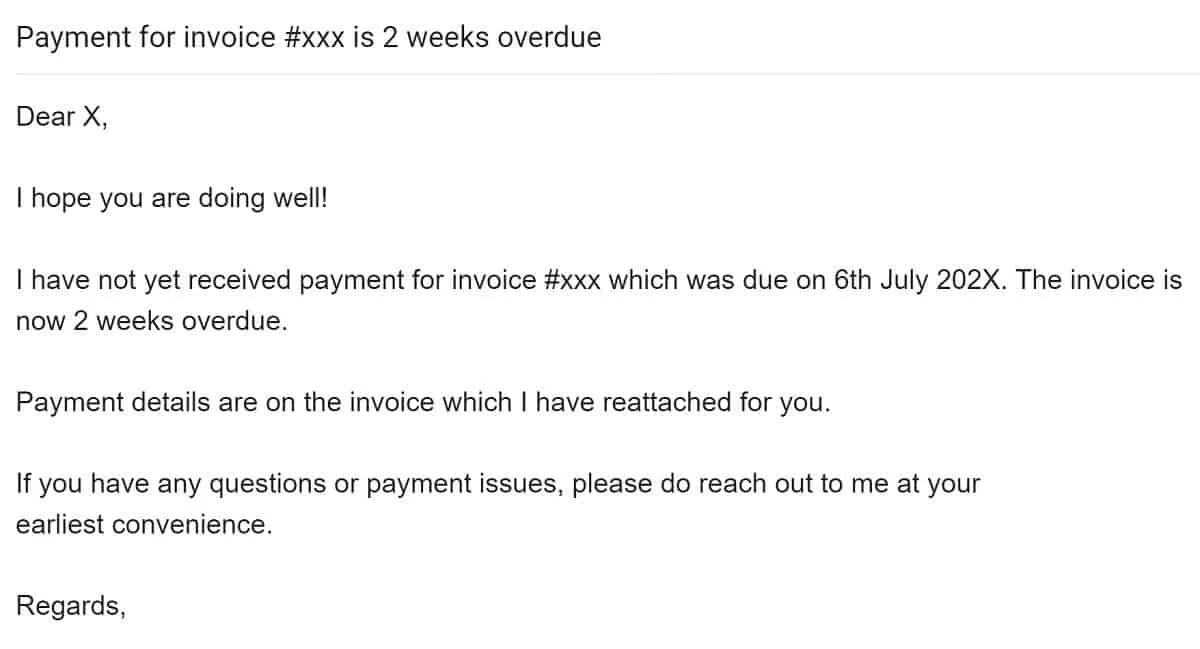

Text to copy paste:

Dear [CLIENT NAME],

I hope you are doing well!

I have not yet received payment for invoice [INVOICE NUMBER] of [INVOICE AMOUNT], which was due on [DATE]. The payment details are on the invoice attached.

If you have any questions or payment issues, please do let me know.

Regards,

[YOUR NAME]

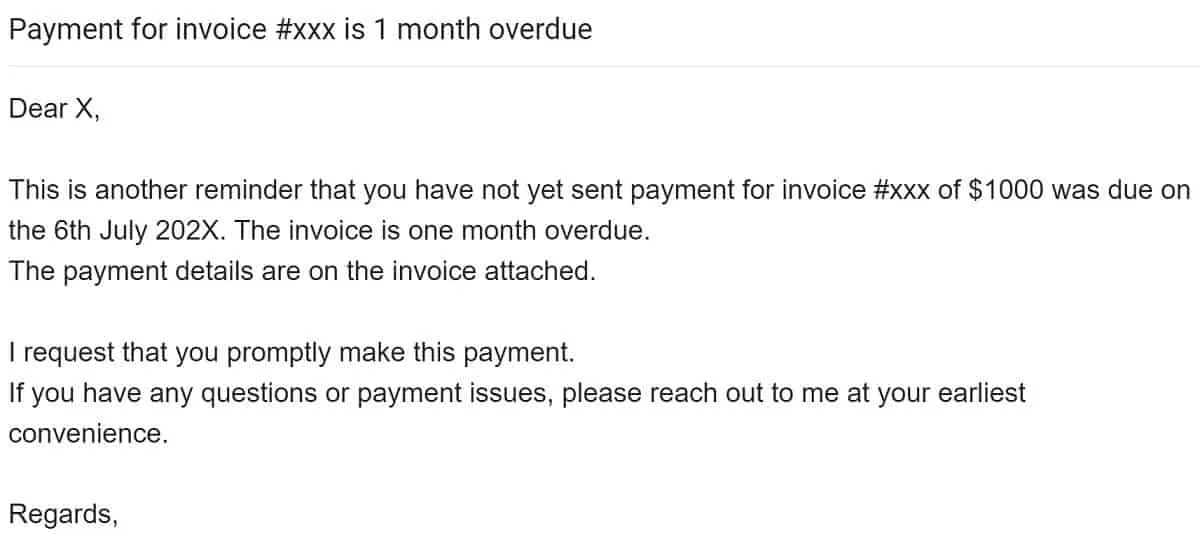

Text to copy paste:

Dear [CLIENT NAME],

This is another reminder that you have not yet sent payment for invoice [INVOICE NUMBER] of [INVOICE AMOUNT], which was due on [DATE]. The invoice is one month overdue.

The payment details are on the invoice attached.

I request that you promptly make this payment.

If you have any questions or payment issues, please reach out to me at your earliest convenience.

Regards,

[YOUR NAME]

If your persistent, polite and punctual emails are not getting through, now is the time to take things onto another platform.

Most would advise that you call the client if your emails are not getting through. I would suggest sending a text message first just to try and arrange the call. This is particularly important if you work with overseas clients.

Send a message to ask to arrange a “chat” about settling their account. Try not to stress out when you do this. Remain calm and polite. Give them at least 48 hours to respond to you before prodding them again.

This is more of a preventative measure on your end than the other way around.

Running a good business is all about building systems and fail-safes. I know that the money owed is definitely important, but your business should not hang on one client’s invoice being paid. We joke that one client’s invoice is the difference between paying rent or not, but how stressful is that as a way of life?

My solution would be to plan for that money to be late. Do your business budgeting a month in advance and only count that money in the bank as arriving 7 days after it is due to arrive. Just trust me on this.

If your client pays early or on time, happy days! No need to panic. If they do pay late, then you have accounted for this in your budget and you won’t starve. It’s also a reason why having an emergency fund is so important.

Not every online accounting system will have auto-reminders as a feature, but having one is still a saving grace. Why? Well, you can normally automatically send out reminders that look far more official than a simple email. There is something about a reminder from an accounting system that removes you from the equation.

The impersonal touch can often work in your favour.

Accounting systems also help you keep track of when invoices are due and when it is time to chase.

Pro Tips

We’ve tested out the most popular invoicing software on the market. Check out our top invoicing software picks for freelancers and small businesses.

Too many freelancers don’t have solid contracts. Your agreement needs to contain:

In all my years of working with clients, I have realised that asking how a client best communicates is extremely important. Some people just aren’t tied to their inbox the same way we are. They may need a nudge on WhatsApp or a phone call to be able to pin them down. Maybe they have an assistant you can contact, or an accounts team.

Knowing this information upfront saves you a lot of headache.

This somewhat depends on the industry that you are in, but deposits really should be more commonplace. I do not lift a finger until my deposit is paid, and this requires a literal level of investment from the client upfront.

A late paying client can be frustrating. Unfortunately, as freelancers and solopreneurs, we’ll have to deal with late payment every once in a while. If you have clear payment terms, a solid contract and a system for chasing payment, you will save yourself a lot of stress!

Be calm, polite and direct with your request for payment and you will be more likely to achieve success with your clients.

Olivia De Santos is a freelance writer, wedding planner and entrepreneur from London, UK. She's a world traveller, wordsmith, film buff, mental health advocate and shea butter enthusiast.