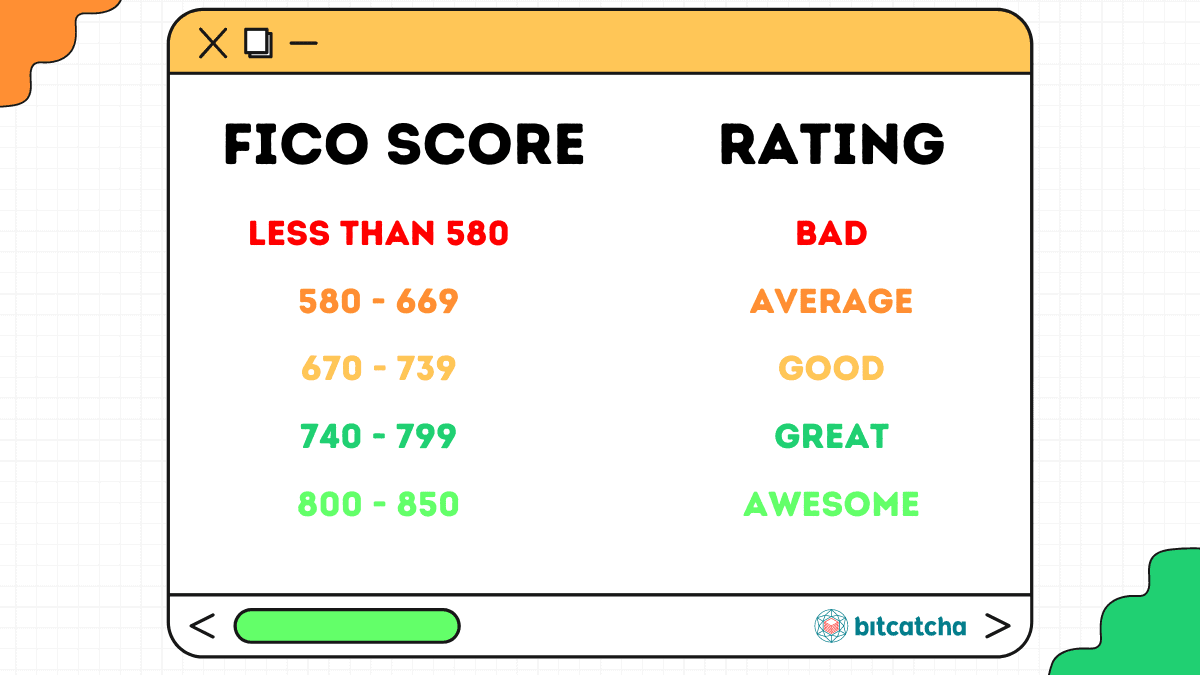

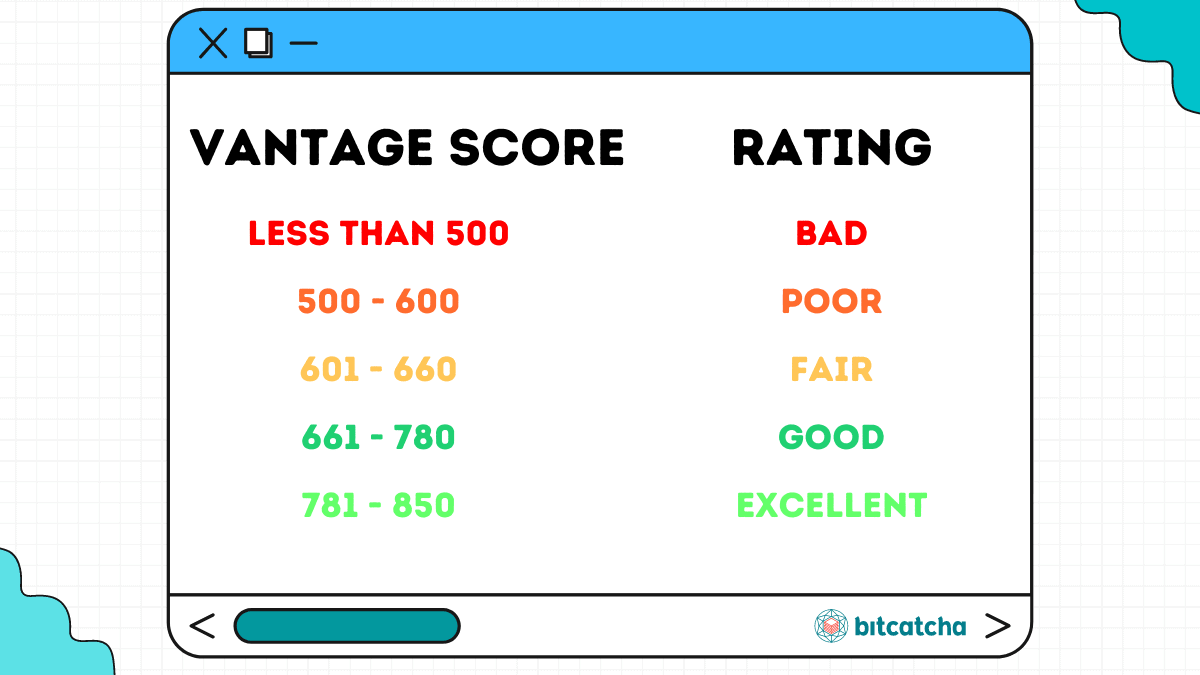

Defining a ‘good’ credit score depends on which scoring system you’re using, and what you’re applying for. Generally, you’ll want a FICO Score above 670 or a VantageScore above 600.

There are some things in life that are almost impossible to pay for in cash. That’s when having a great credit score matters. And that’s probably why you landed here.

This article is all about the two most common credit scoring systems in the United States: FICO score and VantageScore. We’ll explain the basics, the differences, and why a credit good score matters for your financial health.

Your credit score is a snapshot evaluation of your credit risk at a given point in time. By looking at this number, creditors can evaluate the risk of lending money to you.

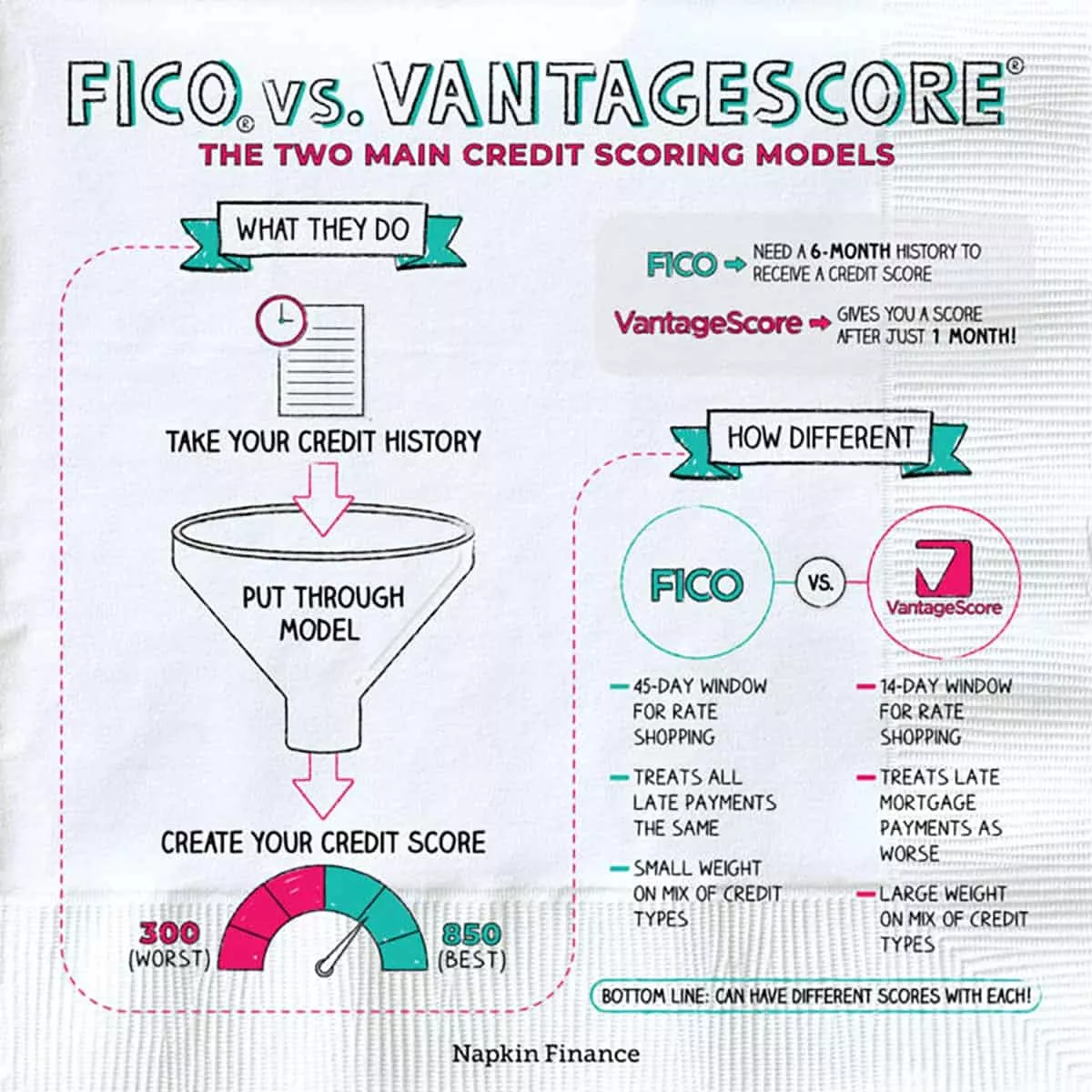

Both FICO and VantageScore credit scoring systems use a score of 300 to 850 points, which is calculated using similar principles.

The higher your score, the better your credit rating, and the higher your chances of getting credit at better terms.

FICO is the most widely-used credit calculation model, so you’ll definitely need to get familiar with it.

VantageScore is a newer and regularly-updated model that’s seeing increasing usage due to its evolving nature. It has another big plus point: it lets you calculate a credit score soon after opening your first credit account! This makes it great for new borrowers.

In essence, both credit scoring systems take a deep look into whether you pay your bills on time, your credit management skills, and the types of credit you have open.

Here’s what each system calculates and how much each calculation is weighed:

| FICO Metric | Weight |

|---|---|

| Payment history | 35% |

| Credit utilization | 30% |

| Length of credit history | 15% |

| Credit mix | 10% |

| New credit | 10% |

| VantageScore Metric | Weight |

| Total credit usage, balance & available credit | Extremely influential |

| Credit mix and experience | Highly influential |

| Payment history | Moderately influential |

| New accounts opened | Less influential |

| Age of credit history | Less influential |

Both of these systems boil down to:

People who can answer “yes” to all of the above will score higher.

Lenders use both systems in their considerations of credit offers, so it’s essential to understand what they are and to maintain good scores in both.

The graphic above does an amazing job of summing up these complex financial scoring systems. Points to pay attention to:

A good FICO score is anything above 670 points.

The Fair Isaac Corporation developed the FICO credit scoring system back in 1989 and has not changed much since then.

A good VantageScore is anything above 600 points.

VantageScore Solutions was created in a joint effort by three US-based credit bureaus (Equifax, TransUnion, and Experian) in 2006.

Currently on its fourth-generation of credit scoring models, VantageScore provides a trend-weighted system that incorporates a wider variety of credit sources. You may find this is a more accurate representation of your credit situation.

Most of us need to apply for credit at some point in life. It lets us pay for large expenses like homes and cars, or to cover expenditures in an emergency.

A good credit score means easier access to credit at better terms. Conversely, those with poor or no credit history may face more denied applications and expensive credit terms. In short, maintaining a good credit score can save you a huge amount of money.

Let’s look at some real-life examples of how a good credit score can benefit you.

Loans for a home are one of the biggest credit-consumers around, taking sometimes dozens of years to pay off.

The creditor makes money off of the interest charged; a difference of just one or two percentage points in annual percentage rate (APR) will make a big impact on your wallet.

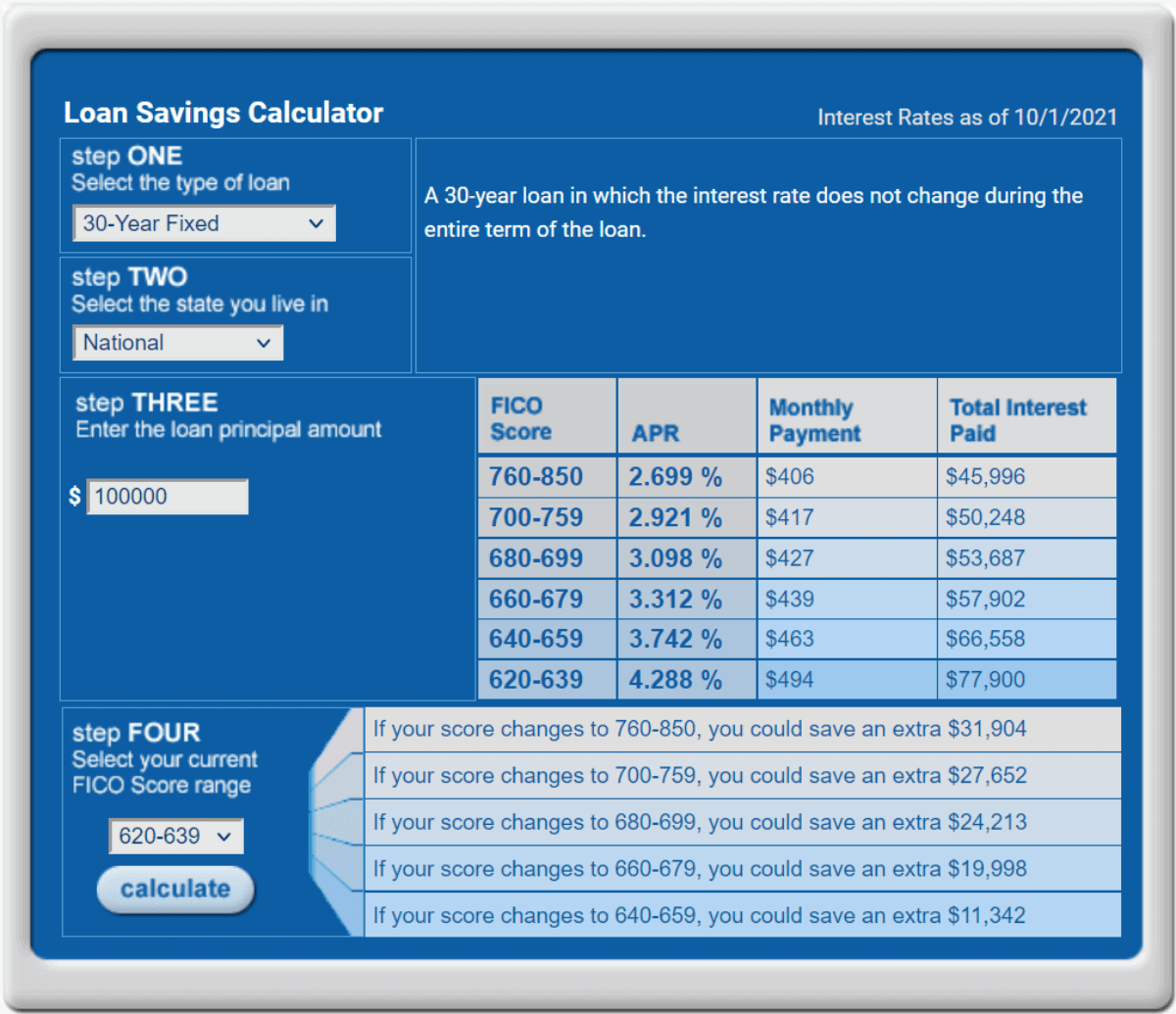

To illustrate this, myFICO has a handy loan calculator that shows you potential loan interest rates and savings based on your credit rating. We gave it a try, inputting a test amount of $100,000 for a 30-year fixed loan.

As you can see, the higher the borrower’s credit score, the less total interest they’d pay.

In fact – the difference in total interest paid between an “average” rating (620-639) versus a “good” rating (700-759) is a whopping $27,408! That means that maintaining a good store can save you up to a quarter of the original loan amount!

Credit scores are one method a landlord uses to screen their new tenants. After all, good ratings usually mean that a tenant will pay the rent on time every month.

Maintaining good credit scores may literally mean more doors opening up for you!

There are two big benefits of a good credit score when it comes to applying for credit cards: access to better cards, and lower annual percentage rates.

The best credit cards (for example – offering low interest, cash back, travel perks, or a rewards program) often require a “good” to “excellent” credit rating. These are to reward people who pay on time, every time.

Just like mortgages, credit cards also come with interest rates expressed in APR. Each card company will have its own offerings, but there is one constant: People with good scores get better terms.

A 2021 report by CreditCards.com showed that the average credit card interest rate was 16.22%.

Since the difference between average vs. bad is around 10%, that’s $10 of extra interest for every $100 of debt – which adds up quickly!

A 10% increase in APR can quickly eat through savings for the unprepared. If you are still building your score, it’s a great idea to pay your credit card bills in full every month to avoid the interest charge.

Now that you have an understanding of how good credit affects credit offerings, let’s take a look at what kind of good credit scores you’ll need to do certain things.

Note: We’ll be referencing FICO scores below.

From our research, it seems that FICO scores below 700 may garner you questions about your credit report. According to Experian data, the average credit score for a car lease in June 2020, was 729.

A score of 650 is enough for good rates on a loan for a used car.

A score of 700+ is better for a loan for a new car.

It may be possible to get a loan even in the 500 range, but expect to pay a significantly higher interest rate.

You can get a 30-year mortgage with scores as low as 500 with a 10% down payment. A FICO score of 580 needs a 3.5% down payment.

There are significant differences in interest rates at the highest and lowest scores, so try to build your score before applying for a loan.

In general, a FICO score of 650 will leave many options available for rental. Anything lower than that may see you searching a bit longer for the perfect place to stay.

There are rental options for those with bad or no scores, but be careful of scams or poor living conditions offered by unscrupulous landlords.

One thing to note is that potential employers don’t see your score – they see the credit report that details your history and balances.

They do this to protect their customers and other employees from a potentially risky candidate. If you’re applying for work in finance, there is a high chance of scrutiny.

The gist of all this comes down to: Maintain a rating of “Good” and higher no matter what scoring model is used for a financially-healthier future!

Your credit score is easily the most influential factor for financial health, so make it a habit to check it regularly.

Here are a couple of methods:

Everyone in the US is also entitled to one free credit report every year from the three major credit reporting bureaus. The report doesn’t calculate the score, but it is important to know what is in it and report any discrepancies.

Good scores are built over time – in general you will need 6 months to build something worthy, so don’t stress if it’s not quite getting there!

One thing about credit score is that any missed payments cause a large reduction in score. It’s therefore a good idea to check your credit report to ensure such discrepancies are fixed.

Got a bad debt that isn’t supposed to be in your report? Dispute it by calling up the credit reporting agency and the business who reported the bad debt – they are required to do it, and do it for free. To speed things up, be ready with documentation such as payment receipts to back your claims.

For other ways to improve your credit score, we’ve written an article on how to build credit; take a gander to find out how to get those scores up, fast!

You should now understand what good FICO and VantageScores are and how they benefit you: Better scores mean more access to products and better terms, especially in the long run.

Considering these trying times of financial stress, it’s more important than ever to stay healthy in our finances!

Leon is a Malaysian-based copywriter with vested interests in music, trading, and crypto. A voracious appetite for reading has given him knowledge over a wide variety of topics and industries.