As the world emerges from its stay-at-home shell of the pandemic, cashless payments are on the rise. Some people are applying for loans to rebuild their lives; others need new jobs after lockdown.

How easily you can do all this is tied to one thing: your credit score. In this article, we’ll be talking about WHY credit score is important and HOW to build a good score.

How To Build Credit WITH A Credit Card

How To Build Credit Score WITHOUT A Credit Card

Good Credit Habits And What To Avoid

Final Thoughts

Although credit score is more relevant in the United States, good credit habits can only help you stay strong financially, especially if you’re a freelancer or small business owner!

Credit score simply means: Are you worth lending money to? Do you pay it back on time?

Score comes into play when applying for insurance, loans, credit cards, homes, phones, and even jobs.

Companies use the score as a baseline measurement so it’s a good idea to keep it in the green.

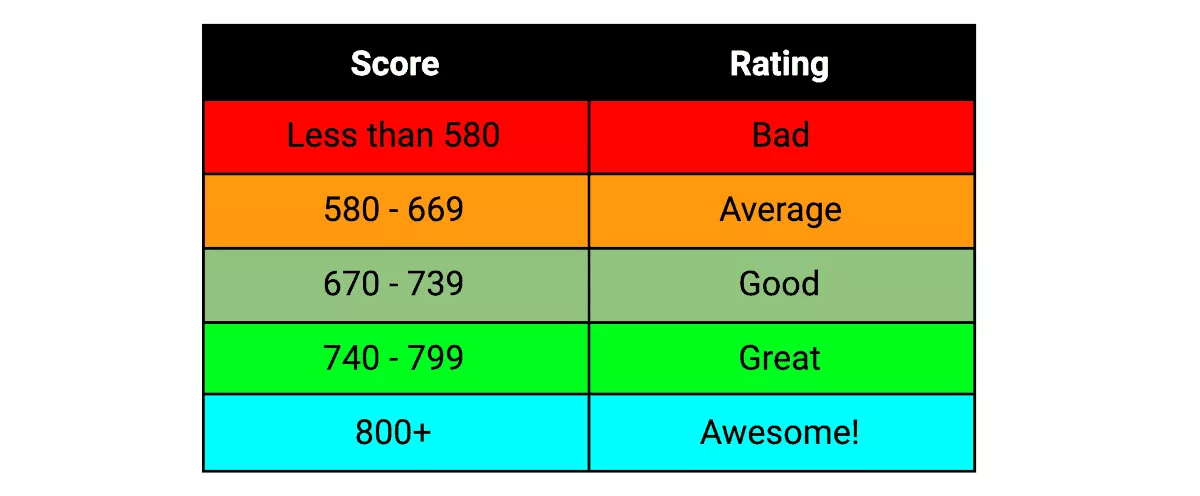

Used predominantly in the US, FICO (Fair Isaac Corporation) credit scores range from 300 to 850.

In general, the scores are tiered as follows:

The scores are calculated with the following weights:

Looks complicated? Not really! Essentially, you want:

Luckily we have a few ways to get you to that level. Read on!

As we’ve mentioned, 670 and up is good.

It means you are less likely to have problems in applying for credit-oriented financial products:

If you’re a freelancer used to being paid in cash and lacking a paper trail, a nonexistent or bad score will deny you many of these opportunities outright, which will certainly put a crimp in both lifestyle and growth.

Here are some examples of what can happen with bad scores:

Now you see how a bad score can become an exponentially more expensive and troublesome problem.

You could run away from bad credit, but that’s not the easiest thing to do, either.

There are 3 ways to get your credit score:

In the world of credit score, “fast” is about 3 to 6 months, while most scores take a year or more to get to.

Look out for “Scorebuilder Tips” throughout this blog for method-specific advice on maxing score building.

Now – let’s get on with the actual advice!

The easiest way to build a credit history (aka score) is with a credit card! Duh.

But what’s the best way to do it?

From FICO’s chart, payment history has a 35% weight in score calculation.

This means paying your debts on time, every time, impacts your score the most. If you miss a payment, it will make a huge dent in your score.

When it comes to credit cards, make sure you regularly keep track of your total credit usage – not having the cash to pay off debt can lead to a downward spiral of bad.

Score-building tips:

Amounts owed (or credit utilization) makes up another 30% of your credit score.

How much credit you have vs. how much you actually use gives you your credit utilization ratio, expressed in percent.

Using $2000 in credit with a $10,000 limit? You’re utilizing 20% of your credit.

The key takeaway here is to avoid using more than 30% of your credit to build a good score. Maxing out your credit every month will make for a slower score gain; missing a payment will be bad.

Score-building tips:

Having more active credit cards means you have a higher amount of credit to utilize. Credit bureaus look at each credit account when calculating your score.

It may be a good idea to cycle small purchases through each card to keep them active. Multiple cards also means you can balance your credit utilization percent between them.

Score-building tips:

If your credit score is bad or fresh (as is often the case with cash-oriented jobs), it may be difficult to qualify for a typical credit card.

One solution is through acquiring a secured credit card!

“Secured” means that you need to put up cash as collateral when getting the card. Your transaction limit will generally be limited up to the deposited amount, but it will build score like a normal card.

Keep in mind that these cards may have higher fees!

Building credit without a card is more complicated but still relies on your history of being a trustworthy, reliable debtor.

The good news is that most of us have such histories.

Good standings in student, auto, and home loans are a plus in your score for up to ten years from the point it was paid off.

To capitalize on this, make sure your loan payments are being reported to the bureaus. Ask your loan providers about it.

Score-building tips:

Today, most major credit bureaus include reported rental payments in your credit file. The important thing is to request your landlord to send their report to the bureau for filing.

Unwilling landlord? You can engage with third party rent reporting agencies to put the rental history to work.

Score-building tips:

That Netflix subscription will come in handy here.

Utilities such as phone bills, cable bills, streaming sites, and other monthly recurring expenses are another way to build score.

Free programs such as Experian Boost collect that payment history to build it into the credit scores they calculate.

Another oft-ignored method of building credit is in applying for and using credit accounts with local retailers. Each store or brand has its own schemes as well as conditions; you need to keep an eye out for offers and ask about them.

Credit accounts are different from credit cards as they are tied to a particular brand. The history is still reported to a bureau so it may be useful for you.

If every method listed before this is unavailable, this is a possible last solution. You need someone who:

Adding your name as an authorized user means the credit account will be calculated into your score. As long as you’re responsible and/or don’t use the credit, your person can rest easy.

Credit cuts both ways though; if your person is delinquent in payments, the bad credit will follow you too!

Trust takes time to build. Even with the best habits and methods, a good score takes at least 6 months to build.

Aside from our Score-building Tips above, you may also try out UltraFico from FICO, another FREE program that leverages your existing checking and/or savings account data to boost your scores.

This is useful for people who direct debit from their accounts and maintain a healthy balance while avoiding overdrafts.

Whew! Now that you know several ways of building credit, maintaining a good score is a combination of good habits and avoiding bad decisions.

Here are some things you should do to keep it in the green:

Everyone in the US gets 1 free FICO credit report every year from AnnualCreditReport.com.

Use that report to spot for any errors or missed payments and rectify them ASAP. Any of these errors can drop your score.

You can also find other free reporting sites or purchase more throughout the year to stay up to date.

Getting hacked is no joke. A stolen credit card or login details can lead to a gigantic deficit in your credit, which drops your score deep into the red.

Keep all your login info stored in a secure location and NEVER login to financial services on public WiFi (that’s a whole other story – you can read up on it here).

Applying for credit is easy these days; too bad applying for many at once drops your score a bunch!

Budgeting for investments and expenses is a great way of ensuring you have the money you need at all times, rather than relying on new credit applications.

Read more here on how to start a realistic budget.

It’s easy to forget about a pending payment these days; we just have so much to do.

Luckily it’s just as easy to set up a payment reminder on your favorite app (I use Google Calendar) to notify about potential payments.

Add a unique, attention grabbing color so the entry pops out!

A lapse in memory or a lack of funds can sometimes lead to a missed payment.

Contact who you owe to show them you are aware of the problem and negotiate a plan on when to pay it. This may convince them not to report the missed payment which can affect your score.

Now you know how best to go about building a credit score. It will take time, but rest assured that it will be worth it.

From improved loan terms to better chances of getting credit, having good credit will give you an easier time of working and living in this world of digital currencies.

Before you go – check out the rest of Bitcatcha’s articles on better money management.

Leon is a Malaysian-based copywriter with vested interests in music, trading, and crypto. A voracious appetite for reading has given him knowledge over a wide variety of topics and industries.