If you mainly deal with minimal amounts of money when doing your transfers, Wise is your guy. It’s an excellent option with super low fees and rates, making it one of the most competitive in the market. Learn more.

In the past, attempting to send and receive money across borders was a costly logistical nightmare. These days though, it’s possible to transfer funds overseas with just the click of a button!

The convenience and lower costs have been made possible by money transfer companies like Wise. They’ve been growing fast, and offer an awesome alternative to traditional financial institutions like banks.

Pros of Wise

Cons of Wise

The Workings of Wise Money Transfer

Wrap Up

If you need to make an international money transfer, chances are you’ve come across Wise. Founded in 2011 as Transferwise by Estonians Taavet Hinriku and Kristo Käärmann, it recently rebranded to Wise to reflect its growing product portfolio.

Although based in the UK, Wise is growing like a weed. Today, the company has offices worldwide, and you’ll find Wise almost anywhere you go – for example, Australia, Belgium, Brazil, the US, China, and more.

The company takes pride in its transparent fee structure and excellent exchange rates; it claims no hidden fees, exchange rate differences, or last-minute surprises. They make it much more affordable to send and receive sums of money overseas.

Honestly, as long as you’ve gotten fed up with expensive bank transfer fees then you’re a good candidate for Wise. It’s especially useful to anyone who needs to make regular transfers, and wants to escape high fees and exchange rates.

Some scenarios where Wise can prove useful;

Setting up a Wise online account will let you send money abroad, get paid in other currencies, and spend money internationally. It’s essentially a borderless account that’s capable of handling multiple currencies.

It’s effortless to sign up for, and with it, you’ll be able to hold different currencies and convert them at the mid-market exchange rate. Because of how Wise works, the account comes with localized bank account numbers across multiple jurisdictions.

The system works exceptionally well for those who frequently transact in more than one country at a time. For many, it’s a great alternative to opening several foreign bank accounts.

Once you sign up with Wise, you get to:

Latest Update: 10 Dec 2021

Wise debit card is now available in Canada, Brazil, and Malaysia! Learn more.

Signing up for a Wise account is free. There are no subscription fees or minimum balances to worry about, and all you need is an email address. You can even create a Wise account with your Apple, Google, or Facebook ID.

Once you have successfully created an account, you can proceed to log in to your account. That will bring you to a neat and clear Wise dashboard. Compared to many online banking systems, the Wise interface is clean and modern.

Take note that although you need not provide any bank account information when creating an account, you’ll need to do so before you can make an actual transfer, along with providing proof of your identity.

Overall, the experience is streamlined. No complications or excessive paperwork necessary.

Everything today is about speed and convenience, so the Wise mobile app can be extremely useful.

It lets you perform your money transfers on-the-go with either an iOS and Android device. The app is full-featured, allowing access to initiating transfers, managing your account, and even the online fee calculator.

The best part about Wise’s system is the simplicity. Wise removes many unknowns and hidden fees when making money transfers.

The Wise system is a little complex behind the scenes, working by swapping funds locally to credit your payees, but you don’t need to worry about all of this. On your end, the process follows a more familiar route.

5 easy steps to send your money:

The time taken for the transfer will vary, depending primarily on the currency you want the recipient to get. Typically, this ranges between 1 to 5 working days. Receiving EUR, for example, only takes 1 or 2 days if sent from countries within the Single Euro Payments Area (SEPA).

Along the way, you can track your transfer status via your dashboard. Wise also sends an email update to the sender and recipient when the transfer is complete.

Although Wise processes only bank account-to-bank account transfers, it allows more flexibility in terms of how you fund those transfers.

You can fund money transfers from bank accounts (ACH, SWIFT, wire transfer), debit or credit card, and even Apple Pay and Google Pay.

Which you should choose will depend on the location of the sender and recipient. Fees will vary based on location, so always read through the summary of your transfer details setup properly before confirming any transfer.

If you need to cancel your transfers, Wise makes it easier by allowing you to do so via its website or mobile app.

Wise allows batch payment processing, up to 1,000 payments at a time! This capability is especially useful if you need to provide payroll support to overseas employees.

Also, payments usually arrive within 1 – 2 days. That means the Wise system is faster than most, making it much more appealing for freelancers and small businesses. As you can see from this, Wise caters to a broad market.

It helps small businesses access global clients more affordably. At the same time, Wise can widen the reach of larger companies, letting them tap into a worldwide talent market.

Thanks to the way their system works, Wise can keep costs down to a minimum. The result is much lower fees, although they vary in some unavoidable ways. Fees are computed based on factors including:

Wise obtains the mid-market rate from Reuters, which updates real-time while the trading market is open.

Since the mid-market exchange rate is constantly changing, Wise allows you to lock in a rate for some of their currencies when you set up your transfer. Once you’ve locked it in, you’re guaranteed that rate as long as you make the payment within the stipulated time frame (usually 24 or 48 hours).

Although it may sound a little complex, working in this manner helps reduce costs resulting from exchange rate fluctuations after confirming your money transfer.

The minimum transfer required by Wise is very low – in fact, practically nonexistent. It’s the equivalent of $1 in your local currency for most cases. There is also an upper limit to note, though, depending on currency and location.

For example, if your Wise account is in one of the licensed US states for Wise, transfer limits can go as high as $1,000,000.

Wise utilizes a network of local accounts around the globe to collect and send funds, skipping the expensive SWIFT network in most cases. That means you can expect to incur no charges from the sending or receiving banks, and no correspondent bank fees along the way.

Do note – Wise may sometimes still have to rely on SWIFT for certain currencies. If that happens, there may be additional charges imposed by correspondent banks (not Wise). The exact cost depends on the amount of the transfer and the recipient bank.

To estimate the costs of sending money with Wise, they offer a simple calculator for use. If you haven’t sent money with them before, you can try it out even before signing up for an account with them.

Just input the amount of money you’d like to transfer, the currency you’ll be sending, and the currency payable to the intended recipient. The calculator then gives you a complete breakdown of all costs associated, and an estimated transfer time. Isn’t that great?

Do note – If you’re paying by credit card, you’ll need to pay a credit card fee of between 0.3% and 2% depending on the currency you’re sending from and the type of credit card you are using. Debit card payments are fee-free for some currencies, but there are occasional charges of between 0.15% and 2%.

Aside from being in business for over a decade now, Wise has other indicators making it a trusted brand. The company registers a strong “Excellent” rating on Trustpilot; as of current writing. It has an excellent 5-star rating from 85% of users who have experienced the system first-hand.

This rating speaks volumes of the quality of service you can expect from Wise.

Reviewers notably commented on;

We feel that some hand-holding would do better where money is concerned regarding the knowledge base. Thankfully, Wise has more personalized assistance available for account holders – so just log in to your account to get more help.

As a whole, the company has very few problems when it comes to security.

The company is a licensed Authorised Electronic Money Institution, which means regulation of Wise is within the purview of the UK’s Financial Conduct Authority (FCA) and Her Majesty’s Revenue and Customs (HMRC).

In the US, Wise is authorized by the Financial Crimes Enforcement Network (FinCEN) and renews its license annually. They’re also licensed as a money transmitter in many individual US states, which means regulatory authorities supervise its operations in every state in which it does business.

In short, Wise has stringent regulatory watchdogs overseeing its operations worldwide. So, you should rest assured when entrusting funds to them. They keep client funds in segregated bank accounts apart from the company’s operating accounts.

Even if, heaven forbid, Wise encounters financial difficulties, your money is still safe.

Wise deploys robust security and encryption measures. Its website offers TLS encryption, and there are other protective measures in place, including two-factor authentication (2FA) and some verification procedures.

The maximum transfer value is $1,000,000 or your local currency equivalent. While that may mean little to smaller companies or freelancers, it limits options a bit for larger companies. If you need to move more significant amounts of money around, things get a little dodgy as well.

Many countries today have fund transfers closely scrutinized by central banks. Unfortunately, even if you split large transactions into smaller ones, you may get into trouble. It’s simply a part of various anti-money laundering procedures, and there’s no way to sidestep things.

Some limits also apply to recipients

While it may sound slightly odd, recipients have some limitations on amounts as well. For example, customers in Singapore are only able to receive SGD5,000 per day (that’s around $3,674). This odd behavior is primarily due to regulation in certain countries, though, and isn’t due to Wise.

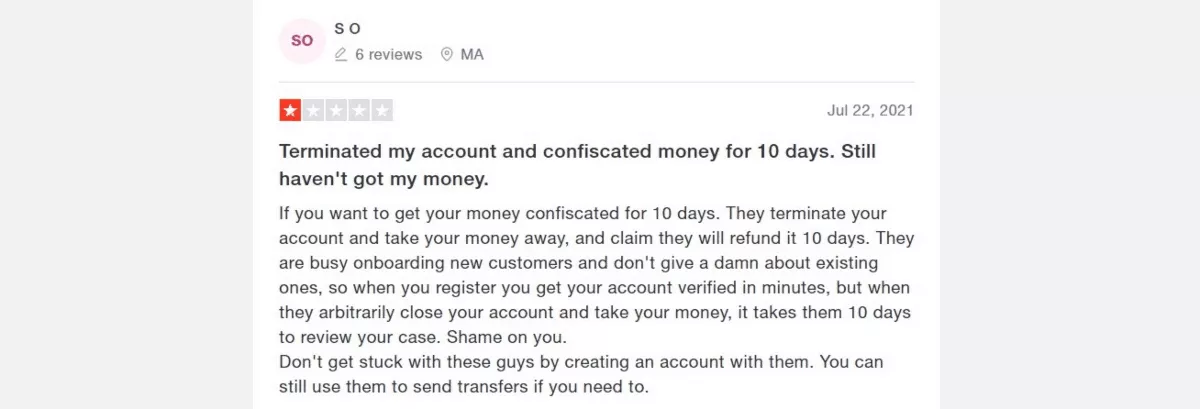

Some users have complained that Wise sometimes arbitrarily cancels transfers and deactivates accounts. This phenomenon is undoubtedly something that sounds alarming. However, some arguments make Wises’ decision somewhat ironclad.

For instance, in many of these cases investigated, the cancellations and deactivations were due to security concerns, detection of multiple accounts, and conflicts with their policies. Wise is a regulated company, meaning it needs to comply with stringent rules to operate.

If they allow violations of their terms of service, Wise may lose their license or put other customers at risk.

There have been occasions when users complained that transactions take longer than specified to carry out. These occasions are mainly due to the company’s unique method of moving money among different currency pools rather than converting it.

Wise doesn’t use standard bank networks most of the time (more on this below); the system relies on local exchanges to help keep costs low. If there isn’t a suitable partner exchange, your transfer could take longer than expected.

The problem with this system is that it’s a double-edged sword. While lower fees make it attractive, those needing a greater degree of reliability in transfer times may have some problems. Unless your payee is very understanding, you might even encounter late fees due to delayed transfer times.

Wise has established a network of international bank accounts – via its locally domiciled subsidiaries – to support the transfer of funds to approximately 90 countries. This system enables Wise to facilitate many transfers without actually having to enter the currency market.

That doesn’t mean that Wise is entirely out of the traditional financial system, though. It still uses some standard tools like the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network.

Rates are guaranteed once you finish setting up a transfer. You can also cancel transfers that haven’t yet been converted or paid, in case you’ve had a change of mind.

In general, bankers are willing to pay a specific price for a currency, and they’re eager to sell it for a particular price as well.

The midpoint of both these prices is the mid-market rate. This rate is the fairest, but to earn more, banks charge you the retail rate, which is higher.

Your bank will also impose other charges like wire transfer fees, administrative fees, and anything else they can imagine. Additionally, your service provider will often keep the difference between the ‘buy’ and ‘sell’ exchange rates. As such, you’ll ultimately end up paying a significant extra amount just to get the intended money across.

Wise removes all such fees and does not convert your funds through a bank. Instead, your funds go into a local account maintained by Wise. Once they find another customer who wants to send a similar amount to your locations, the exchange occurs locally in both countries.

This swapping of money occurs via Wise’s local accounts worldwide. The company also bases exchanges on mid-market rates at the time of your transfer. That means you get a much fairer price compared to transferring via banks.

Wise doesn’t “eat” any differences between the “buy” and “sell” exchange rates, and there’s no exchange mark-up fee either. However, Wise does charge a small percentage fee based on the two currencies you’re converting, which is minimal.

Wise has proven to be a significant disruptor in the international money transfer service industry. And it’s grown explosively in recent years.

With a business model that removes currency conversion charges and most other associated fees, Wise can process money transfers at significantly lower rates than when you go through the more traditional money transfer services.

Additionally, Wise scores well in its easy-to-use, fully-transparent website, and mobile apps, making this a great option for almost anyone.

Whether you make regular transfers or send money overseas once in a while, it would be wise of you to go for Wise – it’s one of the most trusted and least expensive choices around.

If you’re looking for more money tips – check out our other articles and reviews on all things money-related.

Key Features

Recommended For

Currency Support

50+

Overall Rating

![]()

![]()

![]()

![]()

![]()

Advertising Disclosure