Learning how to budget is a superpower. Whatever your situation, being able to better manage your money is a skill that you’ll thank yourself for in the long run.

Budgeting gets even MORE important if your monthly income isn’t set in stone. If you’re a freelancer or small business owner, personal ‘budgeting’ may be the last thing on your mind when there’s already so much to deal with. But don’t let that stop you from doing what everyone should be doing; setting up that budget!

Today, I’ll show you how. We’ll cover:

How to Budget Realistically in 5 Simple Steps

Why Budgets Often Fail (Especially For Freelancers)

Wrap Up

If you’re new to budgeting and need step-by-step pointers for starting, this article is for you!

Put simply, budgeting is the process of creating a plan on how and where your money is spent.

This plan helps you keep your spending in check, and helps you achieve your financial goals.

Budgeting helps you manage your monthly expenses, prepare for life’s unpredictable events, and can even help you afford big payments without going into debt.

Sure, it sounds like a lot of trouble to add on to your daily tasks, but we promise you don’t need to be a math wiz to start!

If your income isn’t fixed – the idea of budgeting can get tricky due to the fluctuations in your monthly income.

But it’s especially because of this unpredictability that freelancers should create a budget. You can then keep track of the income you’re receiving, as well as how much you’re spending, to help you prioritise financial goals like savings or paying off your debt.

Yes, all of it. Even the snack you bought with the spare change you had.

You can’t create a realistic budget without knowing how you normally spend.

It can be scary to see the full amount of your spending without a budget first, but don’t worry! At the beginning, what’s important is knowing your spending habits.

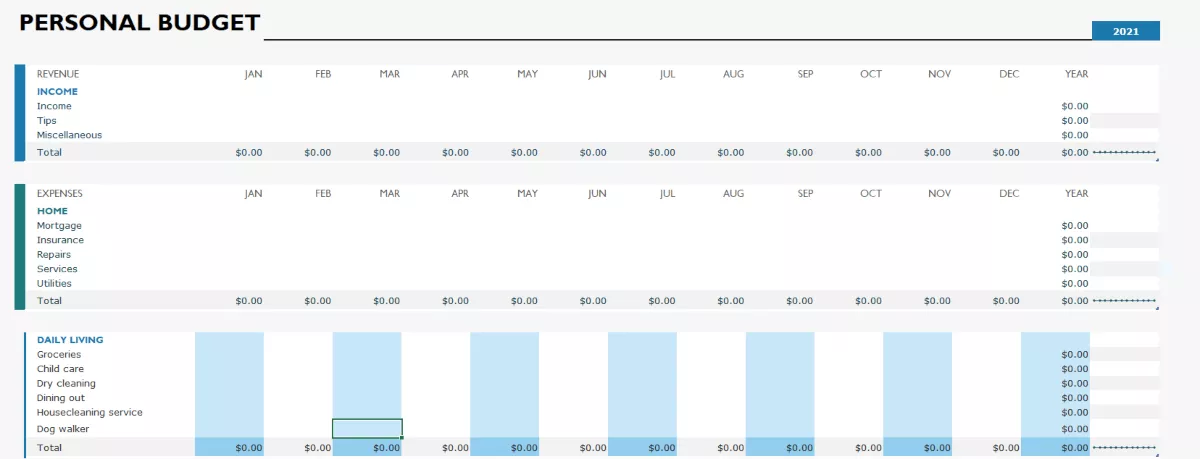

There are plenty of ways you can track these expenses. There are excel sheets, apps like YNAB or Mint, and you can even go analogue by writing it all down if that’s what you prefer!

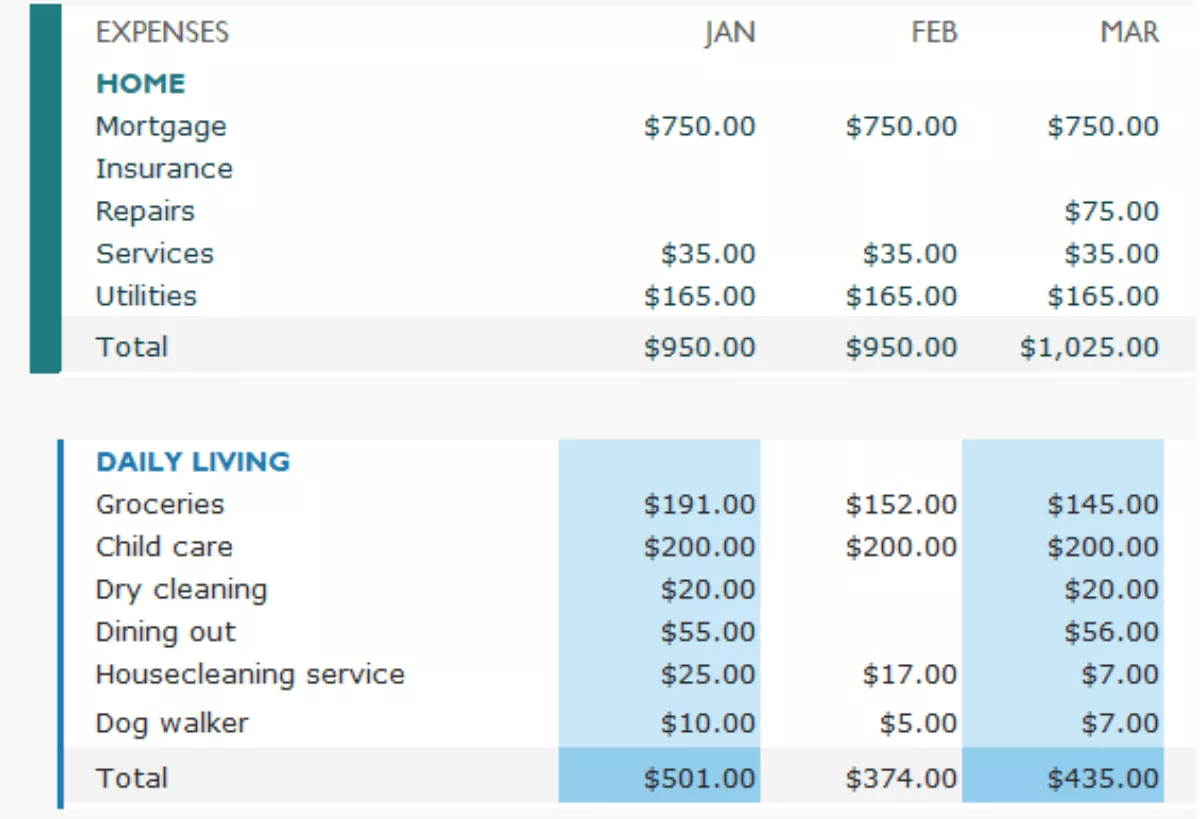

Start by tracking your past three months of expenses. Pull out receipts, check your credit card statements and note your monthly expenses.

Then, place said expenses in categories that give you an overview of where your money is going.

If you’re new and have no record of past spending, you can start tracking now and get at least 3 months worth of data to see what your spending pattern is like.

This gives you a proper view of where your money is being spent, and will help you decide on what your budget should be like later on.

Along with tracking your expenses, you should keep track of your income and how much you’re earning per month.

This will help you plan out your budget, as you may need to make your budget flexible at first – especially if your income remains variable.

| Revenue | JAN | FEB | MAR |

|---|---|---|---|

| Income | $2600.00 | $2600.00 | $2600.00 |

| Tips | $649.00 | $313.00 | $664.00 |

| Miscellaneous | $474.00 | $643.00 | $380.00 |

| Total | $3723.00 | $3556.00 | $3644.00 |

Same as earlier, you can pull out past invoices and bank statements and total your income in past months to help you see a pattern and how much your minimum income is.

In the example image above, the minimum income can be seen as $3500, as that seems to be the average income you’re receiving.

Knowing your income pattern, especially your minimum monthly income which you can base your budget on, helps you create a more realistic budget that works for you too! Try to get at least 3 months worth to go against your earlier spending record.

Once you know how much you’re spending and the income you’re getting, you will need to determine your financial goals and priorities.

It’s always good to have one when planning your budget as this gives you a goal on what you want to achieve, and will keep you determined to stick to your budget.

A common (and very important) financial goal is to have 3-6 months worth of savings to save you during months where your income is a lot lower than usual, or you need to pay taxes.

You can also have other financial goals like paying off your debt, buying useful tools like a new laptop for your work, or even an early retirement fund.

Once you have at least 3 months worth of information on your income and expenses, it’s time to make a formal budget!

Creating a budget means you need to set a maximum spending budget for each of your spending categories and stick to it. This helps you keep your spending in check and ensures you hit your financial goals by the end of the month.

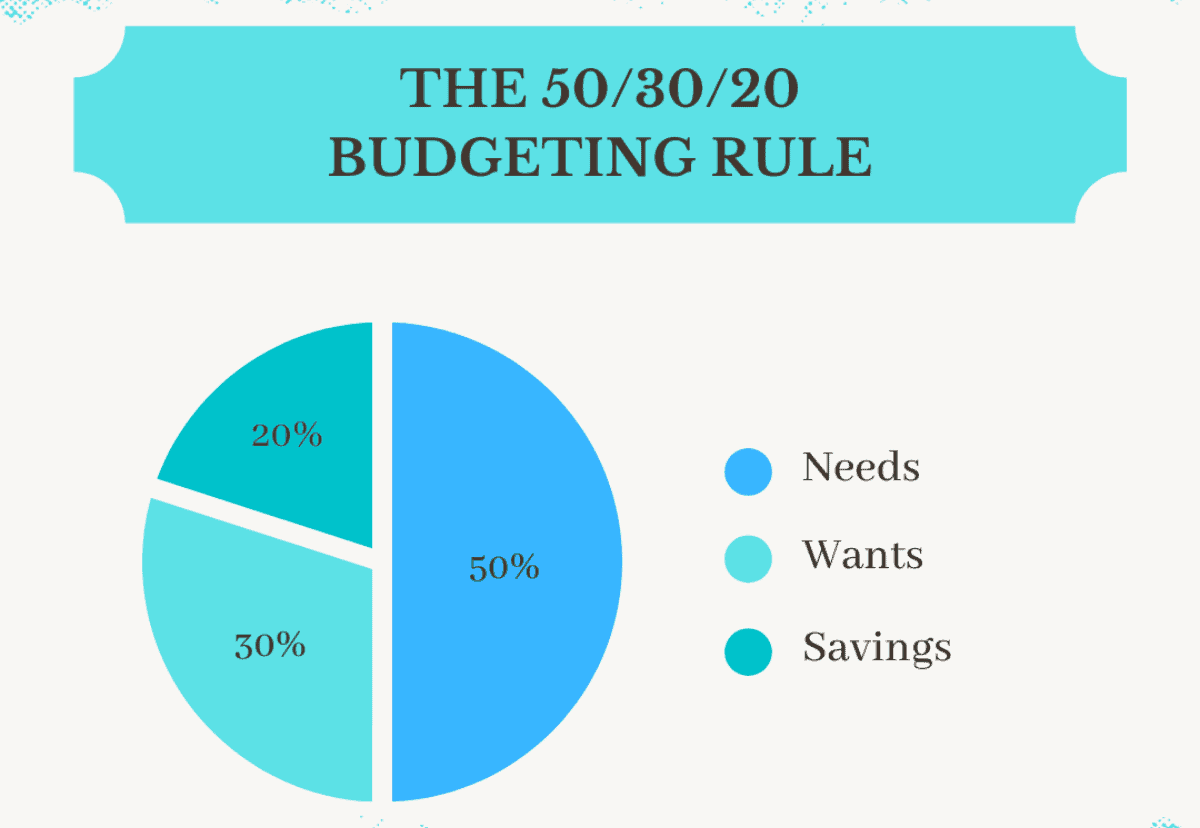

If you’re not sure how to calculate a maximum spending budget, you can start by using the most common budget rule: 50/30/20.

The basic rule of 50/30/20 is to divide up your after-tax income and allocate it to spend in these categories: 50% on needs, 30% on wants, and lastly 20% on savings.

For example, say your monthly income is at $3500. With the 50/30/20 rule, $1750 goes to your wants, $1050 goes to your needs, and $700 goes to your savings.

With this in mind, $2750 is your maximum spending budget; $1750 being spent on necessities like rent and groceries, and $1050 being spent on categories like entertainment and eating out.

| Budget Cost | Actual Cost | Difference | |

|---|---|---|---|

| Rent | $750.00 | $750.00 | $0.00 |

| Transportation | $50.00 | $75.00 | -$25.00 |

| Loans | $300.00 | $300.00 | $0.00 |

| Grocery | $100.00 | $65.00 | $35.00 |

| Subtotal | $10.00 |

Any extra money you get when you spend below budget can then be sent to savings, while any extra spending will eat into your savings instead. If you can stick to this general rule every month, you’re pretty much set!

But it can be challenging to stick to the same budget, especially if your income changes monthly.

And this is where the last step comes in.

While the 50/30/20 rule gives you a rough idea on how to budget, you don’t have to stick to it.

This is especially so if you have a variant income, or your spending priorities have changed as time goes by.

What you can do instead is create a new budget monthly, where you adjust your budget with each new month.

This can be done especially in moments when you know your total income at the end of the month, or you can predict your possible expenses in the following month.

For example, say your recent monthly income was reduced to $3000 due to a late invoice.

If you follow the 50/30/20 rule, your maximum spending budget is now $2400, with $600 savings.

The smaller spending budget is doable as you can cut down on travel and food, but you predict your spending budget still needs to increase as your yearly web host payment is due and it costs an extra $50.

So now you increase your spending budget to $2450 and keep $550 as savings instead.

What’s important when creating your new monthly budget is that you continue to prioritise your financial goals and savings as best as you can.

So that in the months where income is too low and you can’t trim your budget any further, you can depend on your savings as a backup plan.

Freelancing can be a tough gig as you’re doing everything solo. On top of the work you do, you’re playing the role of being your own marketing team, HR manager, and finance department too!

If you don’t have a steady income, do yourself a favor and avoid making these common mistakes as you create your budget:

It can be frustrating to come up with a budget and find that it’s impossible to stick to it.

It may take some time to fully understand your monthly minimum income, along with which clients pay on time, so your budget needs to reflect that.

Bonus Tip

If your clients aren’t paying you on time – here’s a guide on how to chase them up.

Tracking your expenses can be a tedious task, but it’s key to creating a good and realistic budget.

You will need to keep track of how much you spend in all categories to be able to create a realistic budget that works for you. Be it your personal expenses like rent, food, and entertainment, or even business expenses like web hosting, internet bills, and cloud subscription. You will need to keep track of how much you spend in all categories to be able to create a realistic budget that works for you.

It’s understandable that your expenses come first the moment you get your income, but it definitely becomes a problem when your budget doesn’t focus on saving and creating an emergency fund!

An emergency fund helps cushion the hard times of when your income is lower than usual. It can even help when emergency spending comes like your car getting a serious flat tire or even having to pay more in taxes than expected.

As a freelancer, the most important factor in making a budget is being informed on where your money is coming and going. If you’d like to read more tips specifically for freelancer budgeting – check out our article here.

So even if you find it hard to stick to a budget at first, be sure to keep tracking your income and expenses, and then make adjustments accordingly.

Remember, a budget is meant to be personalised to help you reach your financial goals. So go ahead and make that budget work for you!

But on those days where what you’re earning isn’t covering your basic spending already, it’s definitely time to increase your income.

Michelle J Brohier is a passionate content expert in the fields of personal finance and consumer tech. She's always weighing the balance between convenience and value. Connect with her via LinkedIn.