Pricing products is one of the most critical decisions a business owner has to make. Make a pricing mistake, and you’ll have unhappy customers or lost revenue to deal with.

With so many books, articles, and advice out there, it’s easy to fall into the over-analyzing-price spiral before you launch a new store or product. But don’t let this stop you!

In this article, you’ll learn about how to price your product and pick a strategy that hits the sweet spot!

5 Ways To Price Products

More on Product Pricing Strategy

Wrapping Up

This article discusses multiple pricing strategies, from simple to slightly-more-complicated ones, depending on what stage of eCommerce you’re at.

Suppose you already have an online store that’s been running for a while. In that case, your best friend is the product, customer, and competitor data (more on that in a bit).

But, if you’re new and trying to find a price for your products, there is a quick and straightforward way to set a price.

Let’s start with this first, basic cost-based pricing.

The simplest way to price products is using a cost-based pricing strategy.

The key idea is to set your prices based on the cost of producing and shipping each product item. You then add your desired profit margin.

Here’s an example of how it works:

Say, you’re making t-shirts and selling them online. How much should you price each piece?

Well, first, decide what are the costs involved to make one t-shirt.

Materials = $5

Shipping = $10

Labor = $15

Overhead* = $6

Total Costs = $36

Next, decide the markup percentage and add it on top of the cost price. For eCommerce stores, a good percentage is around 45%.

$36 x 1.45 = $52.20

And there you have it, a price that covers all of your costs and gives you a healthy profit margin.

The Cost-Based Pricing strategy is a great starting point for beginners because it doesn’t overcomplicate things.

Just cost, plus a markup % and you get the price. It also doesn’t need a lot of information like sales data, customer behaviors and whatnot – which most beginners often don’t have. So it’s a good place to start.

Haven’t yet built your online store?

If you’re still in the early stages of starting an eCommerce business, make sure you choose a good eCommerce platform. Check out our research on the top eCommerce platforms.

BUT the downside of cost-based pricing is that it doesn’t consider the following factors:

This means it’s not really realistic to stick to this one pricing strategy in the long-term. You’ll probably lose revenue if you ignore the above factors.

This is why we’re going to dive deeper into other pricing strategies that consider all of the above factors. We suggest you check these out, so you can make the best future-forward decision, and keep your price competitive all the time.

In my opinion, competitor-based pricing is the second simplest strategy. This is also what most customers will do themselves: price comparison.

You simply choose to price higher, lower, or on par with your competitors. And each price point gives you a different advantage.

With that said, do NOT price your products lower than your competitors to the point that you’re giving the product away.

A good practice is to take your price (from cost-based pricing) and compare it with your competitors.

If it’s lower, you already have the price advantage. You may even consider increasing the price and reap more profit.

If it’s on par, consider offering more bonuses or freebies to increase your product’s perceived value.

If it’s higher, highlight your product’s quality and anything that makes your business or product unique on your website, product listings, and marketing materials.

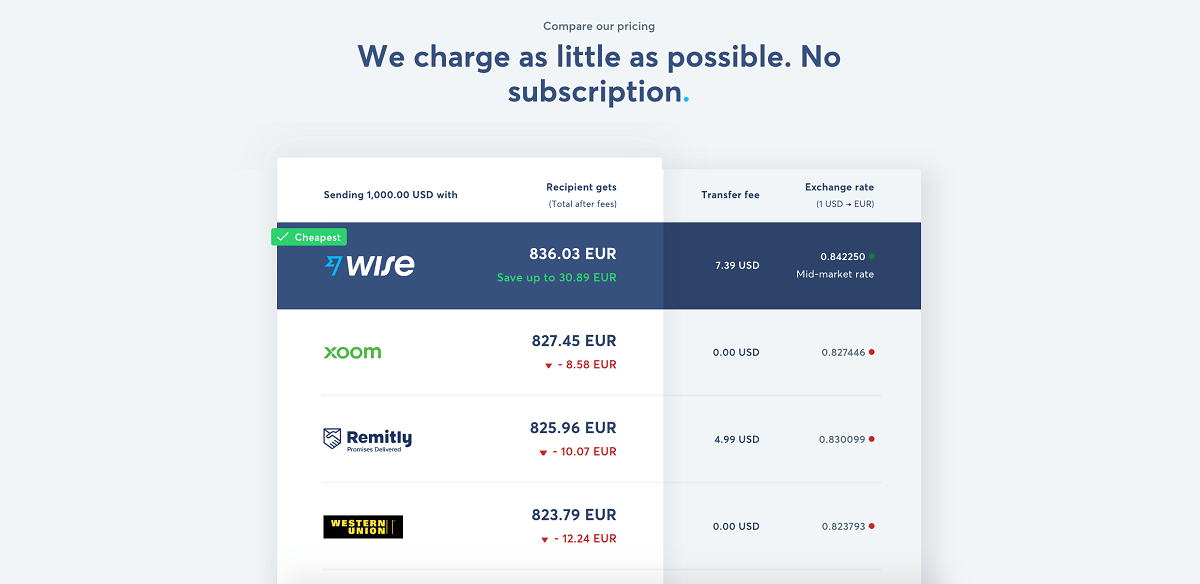

One great example is the money transfer service Wise. The business literally compares the prices with its competitors right at the front page:

If low-price is your unique selling point, like Wise, don’t be afraid to show it to your customers!

I think you’ll agree with me on this one: customers don’t buy ALL the time. There are specific timings or periods where you get 80% of the sale of that month or year. I call that ‘Peak Sales’.

The ‘infamous’ Peak Sales periods are Black Friday, Cyber Monday, Thanksgiving, and Christmas.

Besides, you may also notice you get more sales at a specific time of the day or week. For example, in certain parts of the world, people are more likely to buy things after 10pm, while they’re lounging in their bed and scrolling phones.

Seasonal-Based Pricing is a simple strategy where you match your prices based on your customer’s shopping behaviors.

If you’re new, you may not have the data yet, but you can refer to online shopping statistics such as this E-commerce Stats Report by SaleCycle.

The report says Wednesdays and Thursdays are the best days for online shopping, with peak hours between 10am – 11am, and 8pm – 9pm.

For veterans, you most likely have your customer and product sales data already. Take a good look at how much you’re earning every hour and every day.

Now with the data, you can change your pricing strategies during those specific hours and days. Say you noticed certain hours or days are quieter, you may give some discounts to a specific group of people to reign in more sales.

Just be wary about raising prices at certain times – customers tend to hate that!

Revenue-based pricing is similar to setting a goal and deciding what you need to do to achieve that goal.

Your goal is your revenue target in this context, and you need to decide how many items you need to sell to achieve that target.

Well, if you have only one product, this is simple.

For example,

Number of items expected to sell = 1,500 items

Revenue target = $10,000

Price per unit = 10,000 / 1,500

But, if you have different products, you need to allocate a revenue target for each product, and use the same formula as above.

All of the pricing strategies above won’t work well if you don’t consider your customers first.

Ultimately, the better you understand your customers, the better you’ll be able to provide what they value. The best part is, you’ll be able to charge more.

Market research is the key to knowing your customers. Here are two popular ways to gather customer information:

Suppose you don’t have a few thousand dollars to spend on research. In that case, you might look at customers in 3 distinct groups: 1) the price-sensitive, 2) the convenience-centered, and 3) the status-driven.

You need to price your product depending on which group you’re targeting.

There are so many other pricing strategies out there – but you don’t need to know them all!

If you’re still hunting for inspiration, I’ll quickly touch on 5 more of the game-changing ones here:

Your starting price will almost never stay the same. Your price will change as the market evolves.

But the question is, when is the right time to change your price? Specifically, when should you raise or lower prices?

While there’s no one right timing, there are always some signs you may notice happening around you.

Here are some possible signs that it’s time to raise prices or lower your prices.

Last but not least, make sure to constantly monitor and track how your prices are doing. You should do this every month or more frequently if you’re changing your prices often.

By monitoring and tracking, you’ll be able to see what’s working for the company, competitors, and customers.

This also helps you check that every product you sell contributes toward meeting a monthly goal of generating revenue or reducing expenses – ideally, both.

In short, here are some practices to help you get the right price:

Before you go on your way – check out the rest of our expert tips and advice on how to sell online!

Tifa Ong is a freelance copywriter who writes for coaches and business owners around the world. She’s passionate about enhancing all 5 dimensions of her well-being: physical, mental, emotional, financial, and spiritual.